Introduction: The Cost of Not Knowing Your Market

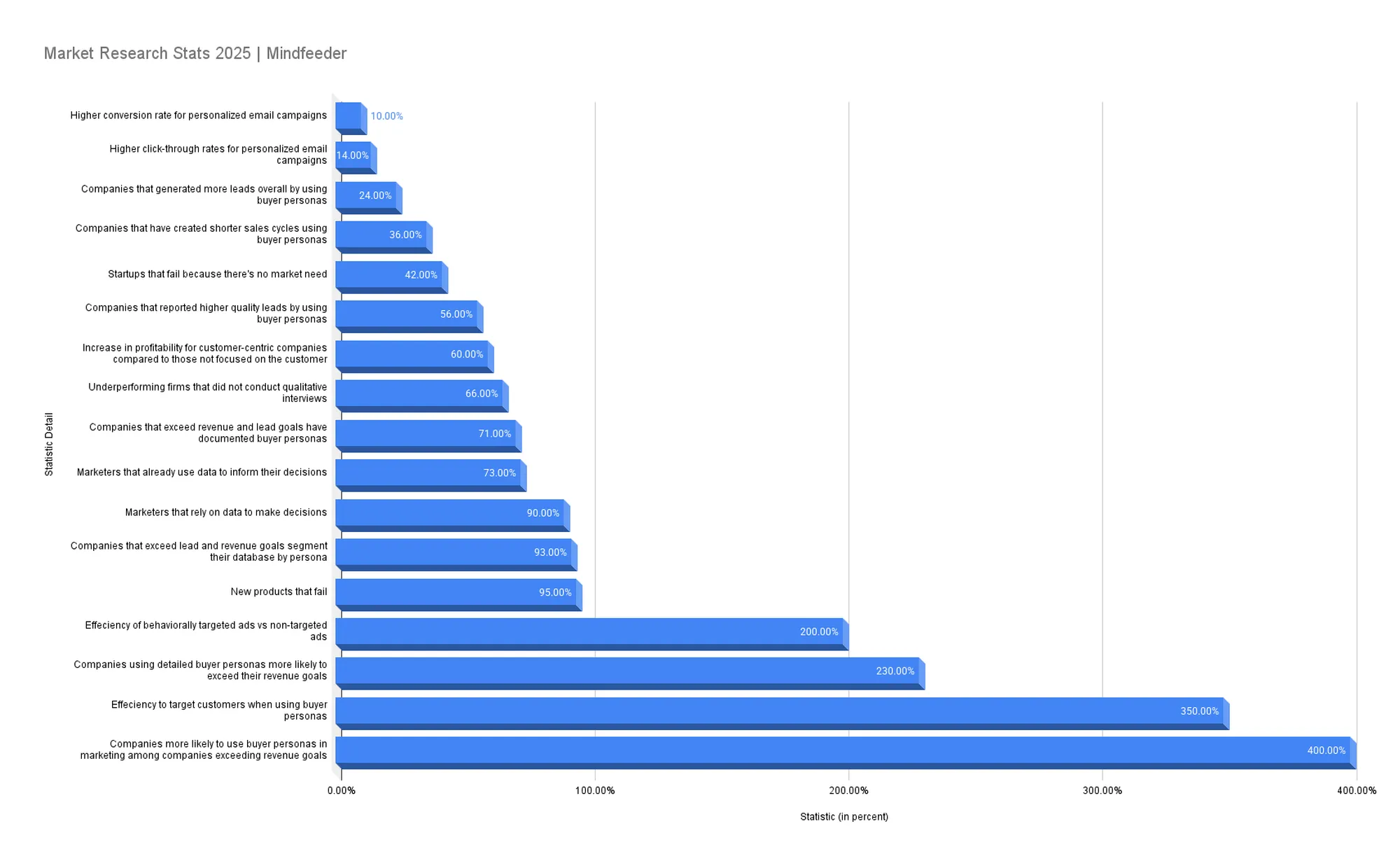

Did you know that nearly 95% of new products fail? It’s a shocking statistic cited by Harvard Business School professor Clayton Christensen. Often, the reason is simple: businesses launch products or campaigns without truly understanding their target audience. In fact, 42% of startups fail because there’s no market need for their product or service – essentially, they built something customers didn’t want.

For small and medium-sized businesses (SMBs), every marketing dollar counts. You can’t afford to waste budget on campaigns that miss the mark. That’s where market research for small business comes in. Think of this as Customer Research 101: the process of gathering data about your ideal customers’ preferences, behaviors, and needs. When you know your audience, you can craft marketing strategies that genuinely resonate – leading to more leads, higher conversion rates, and ultimately better revenue.

Whether you run a tech startup in Austin, a local bakery in Kansas City, or a boutique in St. Louis, understanding your audience is crucial. This guide will walk you through the fundamentals of market research, why it’s so important for marketing success, and how to do it effectively (even on a tight budget). We’ll also show how Mindfeeder uses AI-backed insights to supercharge market research for clients (from Overland Park to Wichita and beyond), and how you can get a head start with a free audit. Let’s dive in!

What Is Market Research for Small Businesses?

Market research is the process of gathering information about your target audience and market to inform your business decisions. In plain terms, it means learning as much as possible about who your customers (and potential customers) are, what they want or need, and why they behave the way they do. This includes understanding their demographics (age, location, etc.), preferences, buying habits, pain points, and even which social platforms or media they use. Good market research also looks at the broader market environment: who your competitors are and what they’re offering, and current trends or changes in your industry.

Why market research is important for SMBs comes down to making informed decisions. Instead of guessing who might buy from you or what marketing message will work, you use data and evidence. This can include:

- Primary research: Directly gathering info from people through surveys, interviews, focus groups, etc. (we’ll discuss methods soon).

- Secondary research: Using existing data and reports (industry studies, census data, market analyses) that others have compiled.

For example, if you’re opening a new cafe in Columbia, MO, primary research could be surveying locals about their coffee preferences, while secondary research might involve reading a report on nationwide coffee shop trends. Both give you pieces of the puzzle about your target audience analysis.

Market research for small business isn’t a one-time task or something only big corporations do. It can be scaled to your needs and budget. Even a solo entrepreneur or a startup can do basic research (like informal customer interviews or using free online tools) to validate that they’re on the right track. The key is to approach marketing with a mindset of “data before decisions.” As marketing expert Dan Zarrella famously said, “Marketing without data is like driving with your eyes closed.”

Don’t be intimidated by the term market research. It can be as simple as talking to five of your customers or analyzing which of your Facebook posts got the most love. Start small – any insight is better than flying blind.

Pro tip

Think of market research as building a customer profile or “buyer persona.” A buyer persona is a fictional representation of your ideal customer based on real data and insights. (For example, “Marketing Manager Molly” might be a persona representing mid-30s marketing managers at SMBs who value efficiency and use LinkedIn daily.) By researching and creating these personas, you get a clearer picture of who you’re marketing to. In fact, companies that exceed their revenue goals are 2.3 times more likely to have conducted buyer persona research than those that miss their goals. When you have this kind of audience insight, it guides everything from the messages in your ads to the channels you use for promotion.

Professional help is available too. Agencies like Mindfeeder specialize in Market Research & Analysis for businesses of all sizes (Mindfeeder even integrates AI to uncover deep insights). The bottom line: market research is about knowing your audience so you can serve them better – which is the foundation of marketing success (know your audience!).

Methods for Conducting Effective Market Research

Market research might sound like a big, daunting project, but there are many methods available – and you don’t need a PhD or a Fortune 500 budget to use them. Below are some of the most effective approaches for truly knowing your audience and gathering insights that drive growth. A combination of these methods will give you a well-rounded picture.

Surveys & Questionnaires

Surveys are one of the most accessible market research methods for SMBs. You can create an online survey in minutes using tools like Google Forms or SurveyMonkey and send it out to your customers or email subscribers. Surveys are great for gathering quantitative data (numbers and multiple-choice answers) from a larger sample. For example, a salon in downtown Kansas City, MO might survey clients about which services they wish were offered, or how they found out about the business.

You can ask direct questions like:

- “How did you hear about us?”

- “What’s your biggest challenge in [the problem your business solves]?”

- “How would you rate your experience with [product/service]?”

Keep surveys short and to the point (5–10 questions max if possible) to encourage higher response rates. Offer a small incentive if you can—like a discount code or entry into a raffle—to boost participation. Don’t underestimate how willing people are to provide feedback; often, all you have to do is ask.

Even a short paper questionnaire at checkout or an email follow-up survey can yield valuable insights for local businesses.

Pro tip

Customer Interviews & Focus Groups

For deeper insights, nothing beats a real conversation. Interviews (or focus groups) involve speaking directly with customers or prospects, either one-on-one or in a small group setting. These are more qualitative, meaning you’ll get detailed opinions, stories, and insights that a multiple-choice survey might not capture.

A cafe owner in Chillicothe, MO could interview a few regular customers to dig into what they love about the cafe and what could be improved. You can do interviews in person, over the phone, or via video call. The key is to ask open-ended questions (“Tell me about the last time you [bought X or used Y] – what was your experience?”) and then listen carefully. These candid comments often reveal hidden “aha!” moments—maybe the customer wishes there was an easier online order-ahead option, or they struggled to understand a certain product feature.

Tip for Interviews/Focus Groups:

- Make participants feel comfortable; emphasize there are no right or wrong answers.

- Ask open-ended questions (who, what, why, how) and let the customer do most of the talking.

- Record the session (with permission) to revisit key insights later.

- Even casual face-to-face chats with customers in a retail store can count as “mini-interviews.”

Interestingly, many companies that miss their targets have neglected this step – one study found that over two-thirds of underperforming firms did not conduct qualitative interviews when developing their buyer personas.

Existing Data & Analytics

You likely already have a goldmine of data at your fingertips. Website analytics, social media insights, and CRM (customer relationship management) records can reveal patterns about your audience at scale.

- Website Analytics (e.g., Google Analytics): Shows you who’s visiting your site, their geography, what pages they look at, how long they stay, and what actions they take. If you notice a lot of visitors from Lees Summit, MO spending time on your “Pricing” page but not converting, maybe your pricing needs to be clearer or better suited to that market. Or if a particular blog post is getting tons of hits, that indicates high interest in that topic—guiding you on future content creation.

- Social Media Analytics: Platforms like Facebook, Instagram, and LinkedIn offer demographic insights and show which posts get the most engagement. If your short how-to video got 3× more likes than other content, that’s a clue about the format or topic that resonates with your audience. Social listening tools can also monitor mentions of your brand or relevant keywords to gauge sentiment (are there frequent compliments, or common complaints?).

- CRM and Customer Data: Look for patterns among your best customers—perhaps they’re concentrated in a specific industry, or they buy certain items in bundles. Analyzing purchase histories can reveal who your real audience is versus who you think it is.

This kind of data-driven research is increasingly common. In fact, 73% of marketers already use data to inform their decisions, and that number grows every year. Reviewing the data you already have often costs nothing but your time, yet can yield insights that guide product development, marketing strategies, and customer service improvements.

Competitor Analysis

Research shouldn’t stop with your own customers. Studying the competition is crucial to understanding the wider market. Look at who your competitors target, how they position their products, and what gaps or pain points their customers mention in reviews. If a competitor’s reviews frequently say, “Excellent service for busy professionals,” that reveals something about their audience and value proposition.

Additionally, tools like SEMrush or SpyFu let you see which keywords your competitors rank for or advertise on, offering insight into their SEO and advertising strategy. By studying the competition, you can spot opportunities: maybe a segment they’re overlooking or a weakness in their product that you can address. This external view refines your understanding of the market landscape and helps you find ways to differentiate your own brand.

Building Buyer Personas

A buyer persona is a semi-fictional profile that represents a key segment of your target audience. It’s basically a character sketch of your ideal customer, based on real data and research. You synthesize individual data points (from surveys, interviews, analytics, etc.) into a clear, shareable picture that keeps everyone on your team aligned.

When creating a persona, consider:

- Demographics: Age range, gender, location, job title or industry, income level, etc.

- Goals & Needs: What are they trying to achieve? Which problem does your business solve for them?

- Pain Points/Challenges: What obstacles or frustrations do they face?

- Behaviors: How do they prefer to shop, consume media, and research products?

- Influences: Who or what influences their buying decisions (friends, influencers, Google search, etc.)?

- Personal Story: Give the persona a name and a brief narrative (“Meet Marketing Manager Molly: a 34-year-old based in Kansas City who needs data-driven decisions to show ROI…”).

For instance, a local gym might identify “Young Professional Yasmine” (busy 20-something looking for quick but effective workouts) and “Retiree Ron” (a 60+ customer who wants low-impact exercise and a sense of community). The marketing approach to attract each persona would differ dramatically—and that’s exactly why personas are so powerful.

If you find that most of your best customers come from Wichita, KS and emphasize affordability, include that in the persona. If interviews reveal that many discovered you through Facebook, note that in their media consumption habits.

Ground your personas in real data, not stereotypes

Companies that use personas effectively see significant performance boosts. One study noted that 93% of companies exceeding lead and revenue goals segment their database by persona. Similarly, another study observed that companies exceeding revenue goals were 4× more likely to use buyer personas in their marketing.

If you need help building out personas, Mindfeeder’s Market Research & Analysis services can ensure you have a crystal-clear view of your target segments.

Audience Segmentation

Hand-in-hand with persona development is audience segmentation—breaking your broad audience into smaller groups with common characteristics. Segments could be based on demographics (e.g., millennials vs. baby boomers), behavior (repeat purchasers vs. one-time shoppers), or geography (urban vs. rural customers), among others.

For example, a restaurant might discover it has two main segments:

- Young professionals who come for quick weekday lunches.

- Families who visit on weekends for a relaxed, kid-friendly meal.

With segmentation, you can tailor marketing strategies to each group—perhaps offering a speedy lunch special to the first segment and a family meal deal to the second. This kind of personalized approach dramatically increases relevancy. As noted, the vast majority of companies hitting their goals are those segmenting their audience—demonstrating how critical it is to treat different groups uniquely rather than as a monolith.

Using Analytics Tools & AI

In the digital age, data is gold. Even a small business generates data—through website traffic, social media engagement, email campaigns, or sales records. Analytics tools help you sift through this data to understand audience behavior at scale, while AI (Artificial Intelligence) can supercharge your analysis by quickly uncovering patterns and making predictions.

- AI-Driven Audience Segmentation: Modern tools can automatically cluster your audience based on online behavior, creating micro-personas that reveal hidden opportunities.

- AI-Powered Survey Analysis: With hundreds of open-ended responses, AI can do sentiment analysis (is the feedback positive or negative overall?) and surface common themes.

- Predictive Analytics: AI can forecast future trends based on historical data—e.g., predicting what product certain customers might buy next or identifying an optimal new store location.

If terms like “predictive analytics” or “AI in marketing” sound daunting, don’t worry—these features are increasingly built into user-friendly platforms you may already use (e.g., some email marketing services suggest send times or subject lines using AI). Facebook’s ad platform uses AI to find lookalike audiences. Survey tools are starting to incorporate AI-driven text analysis. Even a spreadsheet’s “forecast” feature can provide insights without needing a data science degree.

At Mindfeeder, we leverage advanced AI-backed insights in our Consulting & AI Integrations services. But you can still start small: explore free AI tools, or experiment with the built-in AI features in platforms you already have.

@ Mindfeeder

Bringing It All Together

When you combine these methods—surveys, interviews, competitor analysis, persona-building, segmentation, and the power of analytics/AI—you get a robust, 360-degree view of your audience. Market research doesn’t have to be expensive or complicated. It just requires a commitment to understanding your customers’ needs and using that knowledge to guide your decisions. Whether you’re a cafe in Chillicothe, MO or an online retailer serving clients coast-to-coast, these research tactics ensure you stay in tune with what your audience truly wants—leading to stronger marketing strategies, better products, and ultimately, greater success.

The Key Benefits of Market Research & Knowing Your Audience

Why go through the trouble of research? Because knowing your audience pays off in almost every aspect of your marketing. Here are some core benefits, backed by research and statistics:

- More Effective Marketing & Higher ROI: When you understand your customers, you can tailor your messaging and choose the right marketing channels, which leads to less waste and more return on investment. Studies show that using buyer personas (a product of good audience research) can make websites 2–5 times more effective and easier to use for target customers. In other words, your marketing efforts actually hit the mark, leading to better results for each dollar spent.

- Better Quality Leads & Higher Conversions: Market research helps you focus on prospects who are truly interested in your offerings. According to marketing insider data, 56% of companies reported higher quality leads by using buyer personas, and 24% generated more leads overall. When you speak directly to the needs of your audience, they’re more likely to engage. For example, personalized email campaigns (targeted to specific audience segments) see 14% higher click-through rates and 10% higher conversion rates than non-targeted emails. Better targeting = more people taking action.

- Faster Sales Cycles & Improved Sales Alignment: Knowing your audience can shorten the time it takes to close a deal. If your marketing materials address common customer questions and objections (because your research uncovered them), leads move through the sales funnel faster. In fact, 36% of companies have created shorter sales cycles using buyer personas. Plus, your sales team can better understand who they’re talking to, which makes for a smoother hand-off from marketing to sales. When marketing and sales are aligned on the target customer, organizations are much more likely to see higher conversion rates.

- Increased Revenue Growth: Perhaps the most compelling benefit – more sales and revenue. Multiple studies have found a strong link between audience knowledge and revenue performance. One landmark study by Cintell (reported by Business Wire) found that companies that exceed their lead and revenue goals are 2.3 times more likely to have conducted detailed buyer persona research (understanding their buyers’ drivers, challenges, and preferences). Similarly, 71% of companies that exceed revenue and lead goals have documented buyer personas, compared to just 26% of those who miss their targets. Knowing your customers = better bottom-line results. It’s that simple.

“Companies using detailed buyer personas are 2.3× more likely to exceed their revenue goals than those that don’t.” – In other words, truly knowing your audience can be a game-changer for growth.

Pro tip

- More Effective Advertising & Messaging: Research helps you create content and ads that truly resonate. Instead of generic ads, you can use the language your audience uses and address the specific pain points they have. David Ogilvy, the famed marketer, said, “What really decides consumers to buy or not to buy is the content of your advertising, not its form.” When you know what content (topics, words, offers) your audience cares about, your marketing speaks their language. This relevance has a tangible impact: behaviorally targeted ads (ads tailored based on user behavior or persona) are twice as effective as non-targeted ads.

- Stronger Customer Loyalty and Retention: Understanding your audience isn’t just for acquiring new customers – it helps you keep existing ones happy too. When you continually research and listen to your customers, you can improve your product or service to meet their evolving needs. Customers feel heard and valued, so they stick around. Customer-centric companies are 60% more profitable than companies that aren’t focused on the customer, according to Deloitte research. Loyal customers also become brand advocates, bringing you more business via referrals – a nice bonus ROI from your research efforts!

- Product-Market Fit & Innovation: As the earlier statistic highlighted, a huge portion of business failures come from misreading the market. Good market research helps you achieve a strong product-market fit, meaning your product or service truly meets the needs of your audience. By gathering feedback early (through surveys, beta tests, etc.), you can tweak your offerings to better satisfy customers before you pour money into a full launch. This reduces the risk of joining that dreaded failure statistic. Plus, understanding customer needs can spark ideas for new features or entirely new products that your market is asking for. In short, research-driven companies build solutions people actually want – which is the surest path to marketing success.

- Competitive Advantage: Knowing your audience better than your competitors do is a competitive edge. If your competitor is in the dark about customers and just throwing out generic ads, while you’ve done the research to know exactly what customers care about, who do you think will win? Market research can reveal gaps in the market – perhaps an underserved niche or a common customer complaint that no one in your area (from Columbia to Chillicothe, MO) is addressing. With these insights, you can position your brand to fill those gaps and highlight differentiators in your marketing. Essentially, research helps you outsmart the competition by being more in tune with the market’s desires and pain points.

- Data-Driven Decision Making: When it comes time to make a marketing decision – like which tagline to use, or which new service to launch – having research data is like having a trusty compass. Rather than relying on hunches, you can rely on facts. This leads to more confidence in your decisions and often better outcomes. In today’s environment, data-driven marketing is the norm: nearly all marketers (over 90%) say they rely on data to make decisions. Even for small businesses, the tools to collect and analyze data (from Google Analytics to CRM reports) are readily accessible. By embracing this approach, you take the guesswork out of marketing and replace it with clarity.

In short, knowing your audience ensures you’re marketing to the right people with the right message. Instead of throwing spaghetti at the wall, you’re crafting targeted campaigns built on insight. For a small business, that can make the difference between struggling to find customers and consistent marketing success.

Applying Research Insights to Real Marketing Results

Research is only as good as how you apply it. The goal isn’t to collect data for data’s sake, but to turn those insights into actions that drive real marketing results. Here’s how to take what you’ve learned about your audience and use it to improve your marketing strategy:

- Refine Your Marketing Messages: Tailor your value proposition and messaging to hit on the key points your audience cares about. For example, if your research reveals that your target audience (let’s say young professionals in Kansas City) value affordability and quick service above all, your website and ads should lead with messages like “Affordable” and “Fast, same-day service” prominently. Use the language customers use. If several interviewees described your product as “a real time-saver,” consider weaving that phrasing into your copy. When your audience sees themselves in your marketing, they’re more likely to engage. (For instance, if many customers ask “How does this product compare to X?”, consider writing a comparison guide.) By aligning content with customer interests and SEO keywords that your audience is searching (another outcome of research), you’ll attract more organic traffic and engagement. Did someone say content? Insights about customer questions and needs are gold for your SEO & Content strategy – they help you create articles and resources that genuinely add value and draw in your target readers.

- Choose the Right Channels: Focus on the marketing channels where your audience actually spends time. Your analytics or surveys might show, for instance, that a huge chunk of your target customers found you via Google search, but very few via Twitter. That would tell you to invest more in SEO and content (perhaps through a SEO & Content strategy) rather than tweeting 10 times a day. Or maybe your research shows a lot of word-of-mouth happening in a local community Facebook group in Wichita, KS – that could mean you should become active there or encourage happy customers to leave reviews on social platforms. Know your audience marketing means being present on the platforms they use. This ensures you’re not wasting effort shouting into the void on a channel your customers ignore. It also might reveal untapped channels: perhaps a survey shows many customers would enjoy a free workshop or webinar about your service – giving you a new marketing idea to try. Aligning your marketing channels with audience habits increases your efficiency and effectiveness significantly.

- Personalize Your Campaigns: Use your audience segments or personas to create more personalized marketing. Instead of one blanket email newsletter to everyone, you might segment your list by persona or behavior. For instance, a software company could send Persona A (e.g., small retail business owners) a case study about a retail client success, while Persona B (tech startup founders) get an eBook on scaling technology. Personalization can significantly boost engagement – recall that targeted communications greatly outperform generic ones. Even on your website, you might have different landing pages or headlines tailored to different groups (many modern website tools allow dynamic content swapping based on audience data). The more relevant you can make the experience for each user, the better the results. The research you did provides the roadmap for which personalization makes sense. Marketers who leverage persona-based segmentation and personalized content see great results – remember, those that beat their goals often credit their detailed understanding of customer personas for that success.

- Improve Your Product/Service Offerings: Market research might uncover needs that inform product development or service improvements. If customers keep asking for a particular feature or a new product variant, consider investing there. For example, a local bakery in Chillicothe, MO might discover through research that there’s high demand for vegan pastries – that’s a cue to expand the menu and then market those new options to that audience. Marketing success isn’t just about ads and messages; it’s also about offering the right solution. By knowing what your audience really wants, you can align your business offerings to match, creating a virtuous cycle: better product fit leads to easier marketing wins. Every improvement guided by research can be a new marketing selling point. Also, addressing common pain points can reduce friction in the sales process (for example, if a common concern is price, maybe you introduce a flexible payment plan and then promote that heavily). In essence, apply insights internally as well: fix the things that cause customer hesitation and amplify the things they love.

- Adjust and Iterate: After implementing changes based on your research, keep an eye on the results. Did the new targeted Facebook campaign yield better leads? Are sales up after repositioning your service to match customer desires? Continuously use analytics to measure the impact. Market research is an ongoing process. The market isn’t static – consumer preferences change, new competitors emerge, your business evolves. Make it a habit to loop back: research -> action -> measure -> tweak -> research again. For instance, if six months after a campaign you notice engagement dipping, it might be time to gather fresh insights or run another survey.

Let’s say you run an e-commerce store in St. Louis selling eco-friendly home goods. Through customer surveys, you learn that trust is a major factor – people want proof that the products are truly sustainable. You apply this insight by adding detailed sustainability certifications and customer testimonials to your product pages, and create content (like blog posts about your sourcing). As a result, your conversion rate increases because you addressed a key audience concern. This is how research -> insight -> action leads to tangible improvement.

Real World Example

One more thing: sharing findings with your whole team ensures everyone, from marketing to sales to customer service, is on the same page about who the customer is and what they care about. It creates a customer-centric culture within your business, which, as noted, correlates with profitability.

By applying your research insights diligently, you’ll start to see your marketing success take off – because your efforts will be grounded in what actually matters to your audience. The insights gained from market research should flow directly into your marketing plan. They inform who you target, what you say, where you say it, and even what you offer. When you execute marketing campaigns built on a research-based understanding of your audience, you’ll start to see better engagement from customers and a boost in metrics that matter (like lead quality, conversion rates, and sales). It’s the difference between marketing at people and marketing to people in a way that matters to them.

Common Market Research Pitfalls to Avoid

While doing market research and applying it, be mindful of some common mistakes that can undermine your efforts. Here are a few pitfalls and how to avoid them:

- Assuming You “Already Know” the Customer: One of the biggest mistakes is skipping research because you think you have a gut feel for your market. Even if you’ve been in your industry for years, customer behaviors can surprise you. Don’t rely on assumptions or anecdotal observations alone. Always validate with data when possible. Remember the entrepreneurs in Harvard Business Review who boasted about their “revolutionary” product but admitted “We haven’t done the research yet”? Don’t be that person. Research will either confirm your hunches or reveal something new – both are win-wins.

- Confirmation Bias: This is the tendency to interpret information in a way that confirms your preconceptions. If you go into research already sure that your customers think X, you might unintentionally design questions or pick out data that support X while ignoring evidence of Y. To combat this, approach research with an open mind and genuine curiosity. Be willing to discover that you were wrong about something. Sometimes the findings that surprise or even disappoint you are the most valuable, because they present an opportunity to improve. For example, maybe you believe customers love your new feature, but research shows they barely use it—better to learn that and adjust your strategy than to keep pouring money into promoting a dud feature.

- Talking to the Wrong People (or Too Few): If your sample is too small or not representative of your actual audience, you might draw wrong conclusions. For example, only interviewing your five best friends or your immediate family about your business idea might give you biased feedback (they probably want to encourage you). Try to get a diverse mix of feedback. If you have 100 customers, don’t just survey the 5 who gave you 5-star reviews—also reach out to some lapsed customers or those who didn’t buy, to learn why. Larger sample sizes and the right sample lead to more reliable insights.

- Ignoring Unwanted or Negative Feedback: It’s human nature to tune out criticism, but in market research, honest negative feedback is gold. If several people say your app is confusing or your store hours are inconvenient, don’t dismiss it as outliers – dig in and understand why. These uncomfortable insights are opportunities to improve. Similarly, if the data doesn’t match your expectations (e.g., a campaign flopped with millennials but did well with Gen X), investigate it rather than brushing it off. You might discover a new target market or a need to adjust your approach.

- Not Asking the Right Questions: The quality of your research is directly tied to the questions you pose. If a survey only asks “How great are we on a scale of 1-5?”, it’s not going to uncover real improvement areas. Avoid leading questions or ones that are too broad. Instead, ask clear, specific questions that align with decisions you need to make. For example, if you’re debating between targeting two customer segments, ask questions that reveal which segment has greater need or interest in your offering. If you’re unsure why customers choose a competitor over you, ask directly if they’ve ever chosen another provider and why. Good research often starts with good questions – define what you want to learn, then work backwards to figure out what to ask.

- Not Keeping Research Up-to-Date: Markets change over time. A common pitfall is doing research once and considering it “done” forever. Your audience’s preferences in 2023 might not be the same in 2025. New competitors, technologies, or trends can shift the landscape. Make it a practice to revisit your market research periodically – for instance, do a fresh customer survey annually, or update your buyer personas when you notice significant shifts (like a new age group buying your product). Staying current ensures your marketing stays relevant.

- Analysis Paralysis: On the flip side, some businesses collect tons of data and then freeze, unsure how to proceed because of information overload. To avoid this, always tie your research to specific goals or questions. For example, decide “We want to find out which social media platform our audience uses most” or “Why are customers choosing our competitor over us?” Focus on actionable insights – things you can do something about. You don’t need to analyze everything at once. It’s better to act on a few key insights promptly than to sit on a mountain of data waiting for the perfect conclusion.

- Copying Competitors Blindly: While keeping an eye on competitors is smart, don’t assume their audience is exactly the same as yours or that their strategy will work for you. What works in one market or segment might not in another. Use competitor research as a piece of the puzzle, not the whole picture. Your own audience research should guide your unique strategy.

By being aware of these pitfalls, you can conduct and implement market research more effectively. In short: stay open-minded, be methodical, and treat research as a tool to guide you, not to intimidate you. Every misstep avoided is money and time saved for your business.

Market Research Checklist: Quick-Action Tips

Ready to put this into action? Here’s a handy market research checklist for small business owners and marketers. Use these quick tips to kickstart your audience research and marketing improvements:

✅ Define your core audience (or segments) clearly: Who are your ideal customers? Write down basic profiles (e.g., “local moms in their 30s” or “tech-savvy gamers worldwide ages 18-24”). This will focus your research.

✅ Identify burning questions to answer: What do you need to know to market better? For example: “Which social platform do my customers use most?” or “What features do they value most in a product like mine?”

✅ Pick your research methods: Choose at least two methods, like an online survey and a few one-on-one interviews. This way you get both breadth (survey data) and depth (personal insights). If applicable, also gather some secondary research (industry reports or stats for context, many free resources exist such as the SBA or Census data).

✅ Use affordable tools: Leverage free/low-cost tools – Google Analytics for website data, Facebook Insights, Google Trends for seeing what people search, free survey tools, etc. There’s a wealth of information at your fingertips that doesn’t cost a dime.

✅ Schedule time for customer conversations: Set a goal like “Talk to 5 customers this month” whether through a quick call, in-store chat, or Zoom meeting. Hearing voices behind the numbers can be enlightening.

✅ Create (or Refine) Your Buyer Personas: Using the information you gathered, draft at least one or two buyer persona profiles. Give them names and flesh out their characteristics (age, job, goals, challenges, favorite info sources, etc.). If you already have personas from previous years, update them with any new findings. Ensure each persona reflects real patterns you observed, not wishful thinking.

✅ Identify Segment Opportunities: Based on your research, consider if there are distinct groups that emerged. Perhaps you noticed two types of customers – say, “Budget Brian” who cares about cost and “Luxury Lucy” who cares about premium features. Mark down these segments and how they differ. This will help tailor your marketing messages later.

✅ Document your findings: Don’t just keep it in your head. Write a short report or even bullet-point notes on what you learned. Create/update your buyer persona documents with any new info (e.g., add “prefers online shopping” or “main concern is quality” to the persona as needed).

✅ Integrate insights into strategy: Pick one or two immediate actions based on the research. For instance, if you learned customers are unaware of your return policy that they actually value, highlight it in your next campaign. Or if many request a feature, discuss with your team how to implement it. Tie at least one change in marketing or business strategy to the research results so it has a concrete impact.

✅ Set Up Ongoing Listening Posts: To keep the research momentum, set up mechanisms to continuously gather feedback. This could be as simple as adding a feedback form on your website, or regularly checking online reviews for common themes. You might decide to do a survey every year, or put a reminder in your calendar to review analytics monthly. Having these “listening posts” ensures you stay tuned into your audience going forward.

✅ Keep measuring results: After changes are made, watch your metrics (sales, engagement, lead quality, etc.) to see if there’s improvement. This closes the loop and shows if your hypothesis from research held true.

✅ Plan the next round: Mark your calendar for a periodic research activity – maybe a brief quarterly check-in survey or an annual deep-dive review. This ensures you stay aligned with your audience as time goes on.

✅ Consider Professional Help for Deep Dives: If you find yourself short on time or facing a big strategic decision, it might be worth getting expert help. Market research firms or marketing agencies (like Mindfeeder LLC) can conduct in-depth studies, focus groups, or advanced data analysis that an SMB might not easily do alone. Even a free consultation (like our Free Marketing Audit) can point you in the right direction by identifying key areas where more research is needed or interpreting data you’ve collected. Don’t hesitate to reach out – it’s an investment in getting your marketing on target.

Think of this checklist as a cycle: define questions -> research -> apply -> measure -> repeat. It doesn’t have to be perfect or overly complex. Even a quick informal survey or a day of crunching Google Analytics can yield an “aha” moment that transforms your marketing. The key is to start and make it a habit. You don’t need to do everything at once; even implementing a few of these steps will enhance your understanding of your market. The goal is to move from guessing to knowing – and that happens one insight at a time. Remember, effective marketing is built on a foundation of knowledge about your audience. Start building that foundation with these actionable steps.

Conclusion & Next Steps: Invest in Knowing Your Audience

In the fast-paced world of marketing, especially for small businesses and startups, the adage “knowledge is power” couldn’t be more true. Market research is your secret weapon to marketing success – it takes the guesswork out of your strategy and replaces it with understanding. By knowing your audience inside and out, you can create campaigns that truly connect, offerings that truly deliver value, and customer experiences that keep people coming back. The result? Better ROI, higher sales, and a stronger brand reputation.

The great news is that market research in 2025 is more accessible than ever. You don’t need a giant budget or a PhD in statistics to get started. With the tips and methods outlined above, any business owner or marketing manager can begin to harness the power of audience insights. And you don’t have to do it alone, either. If you’re feeling overwhelmed or short on time, tapping into expert help can accelerate the process.

For small and medium businesses, embracing market research can be a game-changer. It levels the playing field against larger competitors by allowing you to be more nimble and precise with your marketing. The good news is that even if you’ve never done formal market research before, it’s not too late to start. You can begin today with small steps – and hopefully, this guide has given you the confidence and tools to do so.

As a next step, consider conducting a quick audit of your current marketing vs. what you know (or don’t know) about your audience. Identify one area where a little research could immediately help. Maybe it’s clarifying who your top customer segment should be, or figuring out why a particular product isn’t selling as expected. Then use some methods from this article to gather insights, and apply that to your very next campaign or business decision. You’ll start to see the difference in how you plan and execute your marketing.

This is where Mindfeeder can partner with you. We specialize in helping businesses (from Kansas City, MO to Lawrence, KS and all across the nation) gain clarity on their market through our Market Research & Analysis services. Our team uses a blend of traditional research and AI-backed analysis to uncover key insights about your customers and industry. We then turn those insights into actionable strategies – whether it’s refining your messaging, identifying new customer segments, or integrating AI tools to keep you ahead of the curve.

Marketing is a lot more fun (and profitable) when you’re hitting the bullseye. By knowing who you’re aiming at – and why they should care about your business – you set yourself up for success. Let’s remove the guesswork and make your marketing truly shine!

Empower your business with knowledge, stay curious about your customers, and never stop learning. Here’s to your marketing success through smart market research! 🎉

We invite you to take the next step: Request a Free Audit from Mindfeeder. This free marketing audit will assess your current strategy and identify opportunities where better audience understanding can improve your ROI. Consider it a friendly jump-start – our way of showing you the value of knowing your audience, risk-free.

Ready to elevate your marketing with data-driven confidence?

Frequently Asked Questions

Ideally, market research isn’t a one-and-done task. For a small business, a light research refresh every 6-12 months is a good practice. This could be as simple as a biannual customer feedback survey and an annual review of market trends in your industry. Additionally, do a round of research before any major decision or change – like launching a new product/service or entering a new market. The market can change fast (consumer tastes, economic factors, new competitors), so staying updated ensures your marketing remains relevant. If you haven’t done any research in a long time, start now with a basic survey or interviews, then set a reminder to revisit later. Regular small updates are better than a huge project that never repeats.

You can still do effective market research on a shoestring budget! Begin with free resources and tools. For example, use free online survey tools (like Google Forms) to gather customer input. Leverage social media – ask questions in relevant Facebook groups or Twitter polls. Tap into existing data: the U.S. Small Business Administration (SBA) and local chambers of commerce offer free statistics and reports on consumer demographics and trends. Google Trends can show you what people are searching for in your area. Also, consider student resources – local universities in Missouri or Kansas often have business students looking for projects; they might help conduct a survey or analysis for free or cheap as part of their coursework. The key is to be creative and resourceful. Listening doesn’t have to cost a lot – even reading through your business’s online reviews or comments is a form of market research. If budget allows down the road, you can then invest in more formal tools or professional services, but plenty can be done with just time and effort.

You absolutely can start doing market research yourself. Many successful entrepreneurs begin by personally talking to customers and digging into data with DIY tools. This hands-on approach can be enlightening and keeps you close to your audience. However, as your business grows or if you’re short on time, hiring an expert or agency can be a smart move. Professionals bring experience, sophisticated tools, and an outside perspective. They might catch insights you overlook and can carry out more in-depth studies (like extensive surveys, focus group facilitation, or advanced data analysis). It comes down to your bandwidth and the complexity of your questions. A middle ground some businesses take is doing the initial legwork in-house, then consulting with an expert to validate findings or fill in gaps (for example, using Mindfeeder’s Consulting & AI Integrations to analyze the data you’ve gathered). If you’re a startup or SMB in a place like Overland Park or Columbia and just need direction, a free audit (like the one Mindfeeder offers) can also point you on the right path without any commitment. In summary: do what you can, and don’t hesitate to seek help when you need deeper insights or lack time.

AI (Artificial Intelligence) can be a game-changer for small business market research by doing a lot of heavy lifting quickly. Even if you’re not tech-savvy, AI-powered tools are becoming very user-friendly. For example, AI can analyze large sets of data (like thousands of survey responses or social media comments) in a fraction of the time it would take a person – highlighting common themes or sentiments. AI tools can also identify patterns in customer behavior, helping with segmentation (you might discover a new customer group that you weren’t actively targeting). There are AI-driven services that can scrape and summarize competitor reviews, giving you insight into what customers like or dislike about competing products. Another area is predictive analytics: some AI tools might forecast customer churn rates or product demand based on historical data. For a small business, this means you get deeper insights without needing a full analytics team. Mindfeeder uses AI in our research process to ensure even smaller clients get enterprise-level analysis. For instance, we might use machine learning to cluster survey results or natural language processing to analyze what people are saying about a brand online in Kansas City vs. online in Wichita. The result is a richer understanding of the market that informs strategy. In short, AI can make your market research more efficient, detailed, and forward-looking – giving you an edge over competitors who rely only on manual analysis.

It’s fantastic to feel in tune with your audience – many business owners develop an intuitive sense of their customers over time. However, even the savviest entrepreneurs have been surprised by research findings. People and markets can evolve. Your customer base today might not be exactly the same as a few years ago. There might be new segments with interest in your business that you haven’t tapped into yet. Also, confirmation bias is real; we sometimes see what we expect to see. Doing periodic research helps challenge or confirm your assumptions with real data. Think of it as a doctor’s check-up for your business strategy – even if you feel healthy, it’s wise to get that expert confirmation. Best case, the research validates that you’re on the right track (giving you confidence to double down). Worst case, it uncovers an area you were missing – which is actually a great opportunity to adjust and capture more market share. For example, you might think only 30-year-olds care about your product, but data could reveal a surprising number of 50-year-olds also find value, suggesting a new marketing angle. Staying curious and open-minded is key to long-term success. So even if you “know” your audience, keep listening – you might deepen that knowledge or spot new trends early.

Absolutely. In fact, the more niche your audience, the easier it can be to research them in some ways. If you have a smaller, well-defined customer base, you might be able to reach a high percentage of them for feedback. Niche audiences often have communities (forums, Facebook groups, local meetups) where you can listen in or ask questions. The key is to tailor your research methods to where your niche audience interacts. You may not find broad industry reports about your specific niche if it’s very unique, but you can collect your own data directly from that community. Every business can benefit from understanding its customers better, whether the customer pool is 100 or 100,000 people in size. In a niche market, even slight differences in customer preference can be magnified, so researching those details can give you a significant competitive edge.

While we’d love to say “yes, for sure!”, the reality is that nothing in marketing (or business) is a 100% guarantee. Market research dramatically increases your likelihood of success by steering you in the right direction and helping you avoid big mistakes. It’s like using a map and compass versus wandering aimlessly – you have a far better chance of getting to your destination. However, success also depends on execution, creativity, timing, and sometimes external factors. Market research won’t automatically make a poor product into a hit or a lackluster ad copy suddenly go viral. What it will do is ensure your decisions are informed and your strategies are grounded in reality, which is a huge advantage. Think of research as a foundational tool: it builds a strong base. From there, great marketing tactics and consistency will stack the odds in your favor to reach those revenue or lead goals.

A well-thought-out UX reduces friction and makes it easier for buyers—whether consumers or businesses—to complete their desired actions.

- E-commerce sites benefit from high-quality product images, simplified checkout flows, and transparent policies that minimize cart abandonment.

- B2B websites need clear calls to action (e.g., “Request Demo”), trust-building case studies, and concise forms that encourage lead capture rather than overwhelm users.

- In both scenarios, the smoother the journey and the more credible the site appears, the more likely visitors are to convert.

Heatmap and session recording tools like Microsoft Clarity, Hotjar, and Crazy Egg let you see exactly where users click, scroll, or get stuck.

- Microsoft Clarity is free and provides insights like “rage clicks” or dead clicks, plus unlimited session recordings.

- Hotjar offers heatmaps, recordings, and user feedback surveys to pinpoint UX problems and gather direct user input.

- Crazy Egg specializes in visual representations like confetti heatmaps and has basic A/B testing features.

- Combining these with Google Analytics (GA4) helps you spot where users drop off, then watch recordings to figure out why, so you can fix issues that hamper conversions.

Structure your content around the user’s goals, using clear menus, intuitive site architecture, and consistent page layouts.

- Keep navigation labels understandable: “Products,” “Services,” and “Contact” are often more effective than clever-but-confusing titles.

- Place essential links in logical spots, use breadcrumb trails for deeper sections, and ensure key conversion pages (like Product or Pricing pages) are never more than a few clicks away.

- Conduct usability tests or watch session recordings to see if people struggle to find information; small tweaks can boost engagement and reduce bounce rates.

Yes—though many best practices overlap, e-commerce tends to focus on quick product discovery and a frictionless checkout, while B2B sites aim to educate and capture leads.

- E-commerce: Emphasize product images, reviews, and an easy checkout flow; reduce cart abandonment by showing shipping costs upfront and offering multiple payment options.

- B2B: Showcase credibility through client logos, case studies, and a strong value proposition on the homepage. Streamline lead capture forms and clarify next steps for prospects.

- Both benefit from fast load times, mobile responsiveness, and trust elements—but the “final action” (purchase vs. demo request) dictates different design priorities.

Treat your website as a living, evolving asset—you should be making smaller, data-driven improvements on an ongoing basis rather than one big redesign every few years.

- Use A/B testing and user analytics tools regularly to catch pain points, fix them, and measure the impact.

- If you notice shifts in user behavior, technology changes, or your business strategy evolves, consider more significant design updates.

- A major redesign might happen every couple of years, but continuous tweaks and optimizations are where you’ll see the greatest long-term conversion gains.

Having more questions? Don’t hesitate to reach out for a free consultation. We’re passionate about helping SMBs in Missouri, Kansas, and beyond succeed through smart, research-driven marketing. Remember: The better you know your audience, the easier it is to win them over. Happy researching, and here’s to your marketing success!

Statistics & References

References

- “95% of new products fail”

-

- Link: https://professionalprograms.mit.edu/blog/design/why-95-of-new-products-miss-the-mark-and-how-yours-can-avoid-the-same-fate/

- Source (Domain/Publisher): MIT Professional Education

- “42% of startups fail because there’s no market need for their product or service”

-

- Link: https://www.revli.com/blog/50-must-know-startup-failure-statistics-2024/

- Source (Domain/Publisher): Revli Blog

- “Companies that exceed their lead and revenue goals are 2.3 times more likely to have conducted detailed buyer persona research”

-

- Link: https://www.growbo.com/best-lead-generation-websites/

- Source (Domain/Publisher): GrowBo

- “Using buyer personas can make websites 2–5 times more effective and easier to use for target customers”

-

- Link: https://blog.hubspot.com/marketing/build-buyer-personas

- Source (Domain/Publisher): HubSpot Blog

- “56% of companies reported higher quality leads by using buyer personas, and 24% generated more leads overall”

-

- Link: https://marketinginsidergroup.com/demand-generation/what-to-include-in-a-buyer-persona-infographic/

- Source (Domain/Publisher): Marketing Insider Group

- “14% higher click-through rates and 10% higher conversion rates”

-

- Link: https://blog.hubspot.com/marketing/build-buyer-personas

- Source (Domain/Publisher): HubSpot Blog

- “36% of companies have created shorter sales cycles using buyer personas”

-

- Link: https://marketinginsidergroup.com/demand-generation/what-to-include-in-a-buyer-persona-infographic/

- Source (Domain/Publisher): Marketing Insider Group

- “When marketing and sales are aligned on the target customer, organizations are much more likely to see higher conversion rates”

-

- Link: https://www.growbo.com/best-lead-generation-websites/

- Source (Domain/Publisher): GrowBo

- “71% of companies that exceed revenue and lead goals have documented buyer personas”

-

- Link: https://unleashpossibledotblogdotcom.wordpress.com/wp-content/uploads/2016/02/final-benchmark-study-understanding-buyers-2016-cintell-2.pdf

- Source (Domain/Publisher): PDF hosted on unleashpossibledotblogdotcom (Cintell study)

- “2.3× more likely to exceed their revenue goals”

-

- Link: https://www.growbo.com/best-lead-generation-websites/#:~:text=In%202016%2C%20Cintell%20published%20a,that%20missed%20their%20revenue%20goals

- Source (Domain/Publisher): GrowBo

- “Behaviorally targeted ads are twice as effective as non-targeted ads”

-

- Link: https://www.protocol80.com/blog/buyer-persona-statistics

- Source (Domain/Publisher): protocol80.com

- “Customer-centric companies are 60% more profitable than companies that aren’t focused on the customer”

-

- Link: https://www.deloittedigital.com/mt/en/insights/perspective/Personalising-The-Customer-Experience.html

- Source (Domain/Publisher): Deloitte Digital

- “Nearly all marketers (over 90%) say they rely on data to make decisions”

-

- Link: https://www.surveymonkey.com/curiosity/marketing-trends-3-strategies-marketers-are-prioritizing-in-2024/

- Source (Domain/Publisher): SurveyMonkey

14. “73% of marketers already use data to inform their decisions”

-

- Link: https://www.surveymonkey.com/curiosity/marketing-trends-3-strategies-marketers-are-prioritizing-in-2024/

- Source (Domain/Publisher): SurveyMonkey

- “What is a Buyer Persona?”

-

- Link: https://buyerpersona.com/what-is-a-buyer-persona

- Source (Domain/Publisher): BuyerPersona.com

- “One study noted that 93% of companies exceeding lead and revenue goals segment their database by persona”

-

- Link: https://marketinginsidergroup.com/demand-generation/what-to-include-in-a-buyer-persona-infographic/

- Source (Domain/Publisher): Marketing Insider Group

- “Companies exceeding revenue goals were 4× more likely to use buyer personas in their marketing”

-

- Link: https://marketinginsidergroup.com/demand-generation/what-to-include-in-a-buyer-persona-infographic/

- Source (Domain/Publisher): Marketing Insider Group

- “What is audience segmentation?

-

- Link: https://thecompassforsbc.org/how-to-guide/how-do-audience-segmentation

- Source (Domain/Publisher): The Compass for SBC

- “One study found that over two-thirds of underperforming firms did not conduct qualitative interviews”

-

- Link: https://marketinginsidergroup.com/demand-generation/what-to-include-in-a-buyer-persona-infographic/

- Source (Domain/Publisher): Marketing Insider Group

- “Remember the entrepreneurs in Harvard Business Review who boasted about their “revolutionary” product but admitted “We haven’t done the research yet”

-

- Link: https://hbr.org/2011/04/why-most-product-launches-fail

- Source (Domain/Publisher): Harvard Business Review (hbr.org)

*Note: The above sources provide data and findings that informed this report. Wherever possible, the exact statistic or claim has been cited with the corresponding reference tag for verification.